When you position your product or company, the value proposition is typically grounded in brand fundamentals that are expected to remain core to the business across multiple years. So how and when do you adjust your positioning for normal evolution and growth? What happens when market conditions change so dramatically that they impact your central point of difference?

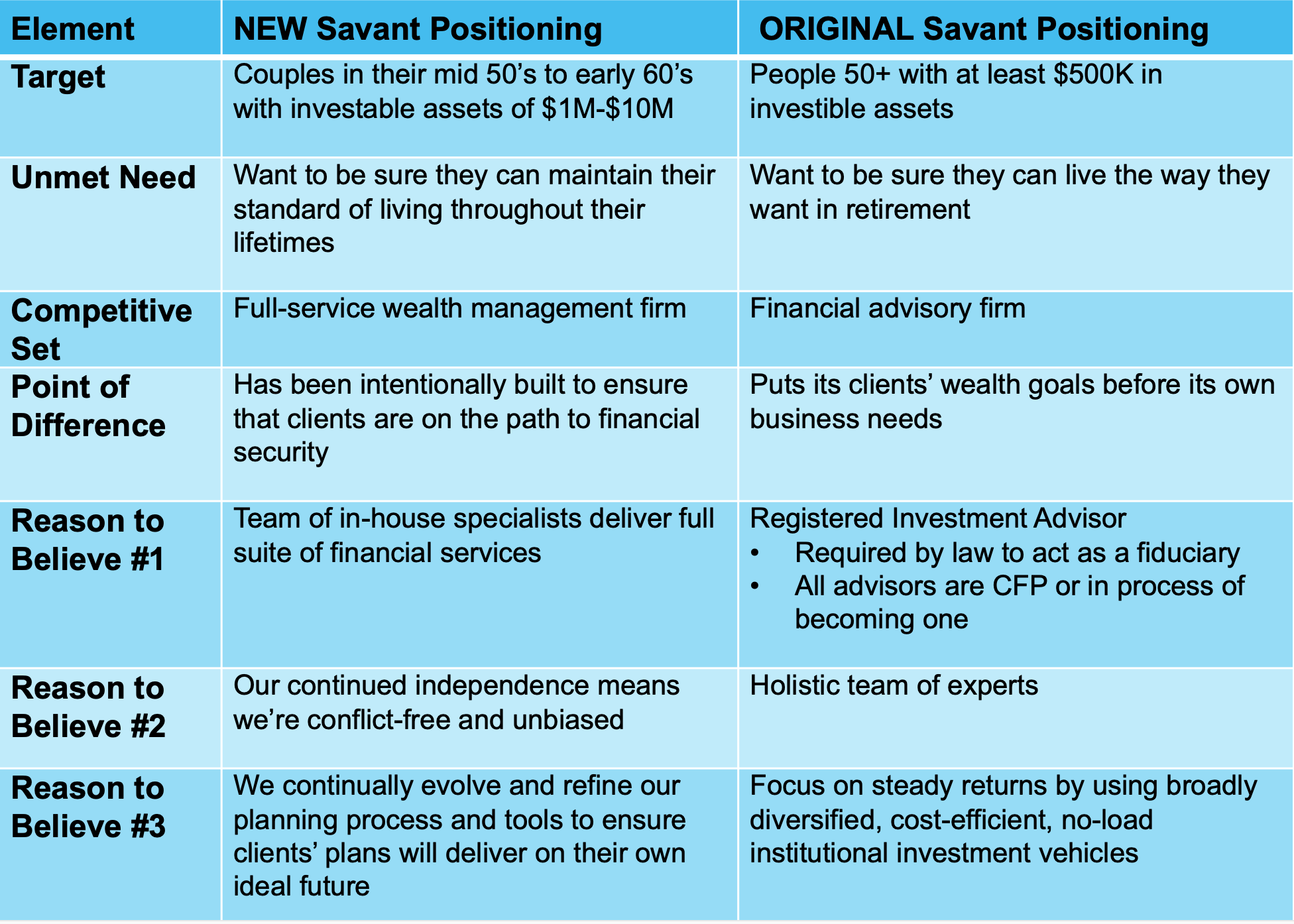

We worked with two returning clients this year to evolve their positioning statements. One of the clients, Savant Wealth Management, has grown significantly and expanded their service offerings since we first worked on their positioning statement in 2013. Since that time, their assets under management grew from $3B to over $11B and they’ve added new services like tax preparation and trust and estate planning.

In this case, we went back to the drawing board and did another positioning exercise with the team. There were some key differences this time around:

- We were able to work with a sub-team of core stakeholders since the CEO was already familiar with the process.

- We didn’t have to start from scratch. Since our process involves capturing all the inputs considered during a positioning workshop, we were able to review all of the previous positioning inputs and include those that were still relevant.

- We interviewed only people who could provide insights into Savant’s new processes and services.

- We were positioning Savant as an overall company versus its individual divisions like Wealth Management or Accounting.

Here’s the comparison of Savant’s original versus current positioning:

When we originally worked with Savant, they created a special document to familiarize their entire organization with the positioning work. You can read a blog post about it here: All Aboard! Sharing Positioning With Non-Marketers.

WAV’s situation was quite different. As a major distributor of broadband and LTE equipment, WAV, like many companies dealing in physical equipment, has had significant supply chain issues as a result of Covid. For most companies, this would not impact the positioning statement. But in WAV’s case, their point of difference is directly tied to their inventory levels: Holds the largest and most consistent inventory position in the industry. Since Covid, this has been a struggle for the WAV team with chipset shortages and dramatic increases in demand for internet connectivity. WAV didn’t feel like this statement would be broadly accurate until the country’s supply chain issues have resolved.

Thinking more broadly, however, all their competitors are in the same boat. But that doesn’t change the fact that the WAV team is continuing to work hard every single day to maintain the largest and most consistent inventory. Their fantastic Reasons to Believe haven’t changed:

- Focus on continually reinvesting in their business and their partners’ businesses to keep stock levels where they should be.

- Have a dedicated, experienced supply chain team that uses advanced analytics tool for forecasting

- Experienced sales team works closely with supply chain on a regular basis to ensure accurate forecasting that is then aligned with their manufacturing partners.

The striving and working hard part remained true. However, it was no longer a given that that hard work would pay off every day. So we suggested a simple tweak to their Point of Difference, starting with six additional words: We work hard every day to…as in:

We work hard every day to hold the largest and most consistent inventory position in the industry.

It’s still true and, most importantly, it’s still differentiating! You can read the story of WAV’s original positioning work here Is Your Point of Difference Buried Treasure?